Life Insurance in New Jersey that Creates Security & Wealth

It isn't about you. Life insurance is something you need to help protect those you care about financially if you are no longer able to work. Life insurance may be the only thing that stands between you and financial instability for your loved ones

Book a Consultation

Have a question? Send us a message and an agent will be in touch shortly!

Here is a little more about our plans

We have a variety of different plans to suit you and your family's insurance needs.

Life Insurance

It’s not about you. Life insurance is something you do to help protect those you love so they don’t suffer financially if your income is no longer there. Life insurance can be the only thing that stands between your loved ones and financial hardship.

Supplemental Health

Being prepared is important … especially if you develop a health problem like cardiovascular disease, stroke, cancer, or are involved in an auto accident that lands you in intensive care. These events can impact not only your health, but also the financial wellbeing of your family. American Income Life can help you be more prepared to face the future.

It’s been more than 70 years of New Jersey life insurance trusted by thousands of clients

Today, AIL is one of the nation's significant providers of supplemental life insurance to labor unions, credit unions, and associations. American Income Life covers more than 2.5 million policyholders and represents more than $273 million in annualized life premium sales in 2021.

2 Million

Policyholders

33,124

Claims Paid by AIL 2021

Over 70

Years Of Experience

New Jersey life insurance that you can depend on.

AI Life has served working class families since 1951 with life, accident, and supplemental health products to help protect members of labor unions, credit unions, associations, and their families. AIL representatives develop long-term relationships with clients and meet them where they are most comfortable: their homes (virtually or physically).

Get all the information you need with a few key details

What is Life Insurance?

Life insurance is required to cover the "what ifs" in life. What if I pass away unexpectedly? Could my family still live in our house? Would my children be able to afford college? Will my family have enough money to cover my funeral and final expenses? Life insurance exists to provide financial assistance to those affected by "what if" scenarios.

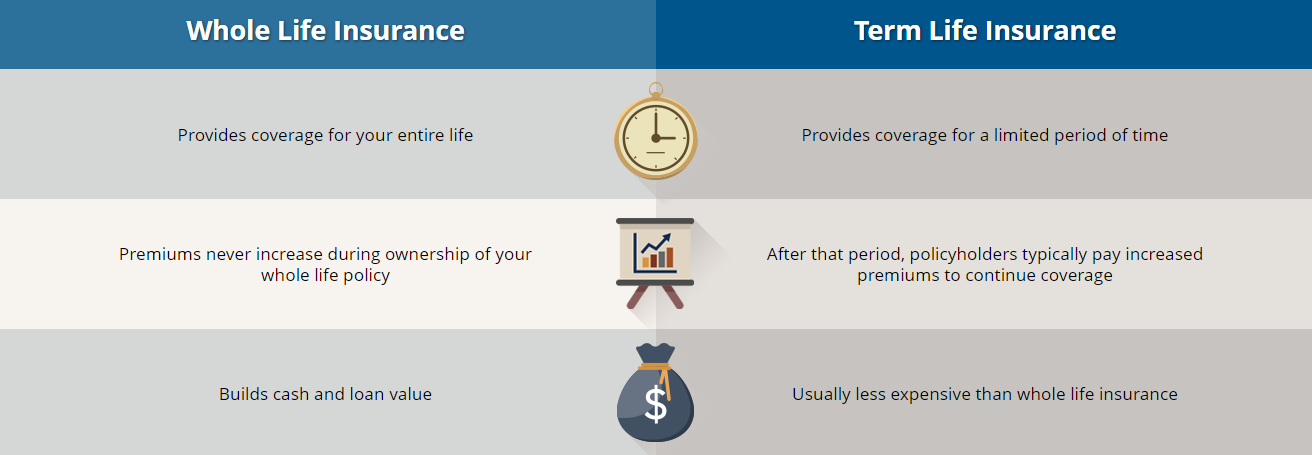

Whole life insurance in New Jersey vs term life insurance

There are two types of insurance: whole life and term life. The specifics of your life — age, income, and other factors — help determine which type of and how much life insurance is appropriate for you.

But one fact remains true: funds for your funeral and final expenses will always be needed.

If the loss of your income would negatively impact those who depend on you, consider adding a term life policy to a whole life policy. Term life insurance can help your family if you die during your peak earning and asset accumulation years.

Get a Consultation

Contact Us

Give us a call!

(973) 576-8698